Strategic Global Sourcing:

How Companies Move from Cost Saving to Competitive Advantage

Supply chain disruptions now cost the average organisation about $184 million annually.

For decades, global sourcing was treated as a cost-reduction lever. Production was moved offshore, suppliers were negotiated hard, and success was measured by unit price.

For a long time, that approach worked.

Today, not so much.

Global supply chains are operating in a world shaped by geopolitical volatility, trade restrictions, labour shortages, ESG scrutiny, and brutally short product lifecycles. In this environment, sourcing decisions don’t just affect cost -they dictate continuity, speed to market, scalability, and whether your business can actually keep the lights on.

That’s why global sourcing has quietly changed jobs.

Global sourcing has shifted from a transactional procurement activity to a strategic capability. Companies that get this are building resilience and flexibility into their operations. The ones that don’t are finding out the hard way what single-point dependency really costs.

“Many supply chains are perfectly suited to the needs that the business had 20 years ago.”

— Jonathan Byrnes, MIT lecturer

What Strategic Global Sourcing Actually Means

Strategic global sourcing is often lumped in with traditional international sourcing. That’s a mistake. They may look similar on a map, but the intent is completely different.

Traditional sourcing typically focuses on:

- Unit cost reduction

- Short-term supplier negotiations

- Single-region dependency

- Reactive responses to disruption

Strategic global sourcing does something else entirely.

It intentionally designs a global around long-term business objectives.

That means thinking about:

- Total landed cost, not just headline price

- Geographic diversification to reduce dependency

- Long-term supplier partnerships rather than transactional switching

- Alignment with product roadmaps, NPI timelines, and end-market demand

The question shifts from “Where is the cheapest place to make this?” to “What sourcing model lets us compete, scale, and adapt over time?”

This shift in mindset is where competitive advantage begins.

88% of businesses plan to reconfigure their supply chains in 2025, mainly through diversification and localisation strategies to balance risk and market opportunity.

Why Global Sourcing Has Become a Board-level Issue

This shift didn’t happen because consultants needed new slides, it’s driven by structural changes in how global manufacturing operates.

Geopolitical and trade volatility

Tariffs, export controls, sanctions, and fragile trade relationships have made single-country sourcing a gamble. Decisions that once felt safe can unravel overnight.

Supply chain resilience

Recent disruptions have exposed how fragile centralised supply chains can be. A shutdown, logistics bottleneck, or labour and global production stalls.

Speed to market

As product lifecycles shorten, speed has become a differentiator. Manufacturing location directly affects lead times, responsiveness, and ramp-up efficiency.

ESG and compliance pressures

Environmental, social, and regulatory requirements are now embedded into sourcing decisions. Traceability, labour standards, and compliance obligations increasingly influence where and how products are made.

Strategic global sourcing responds by designing resilience and flexibility from day one, instead of reacting after the fact.

From Geography Decisions to System Design

One of the most common mistakes companies make is treating global sourcing as a country-selection exercise.

In practice, strategic global sourcing is about system design, not just geography.

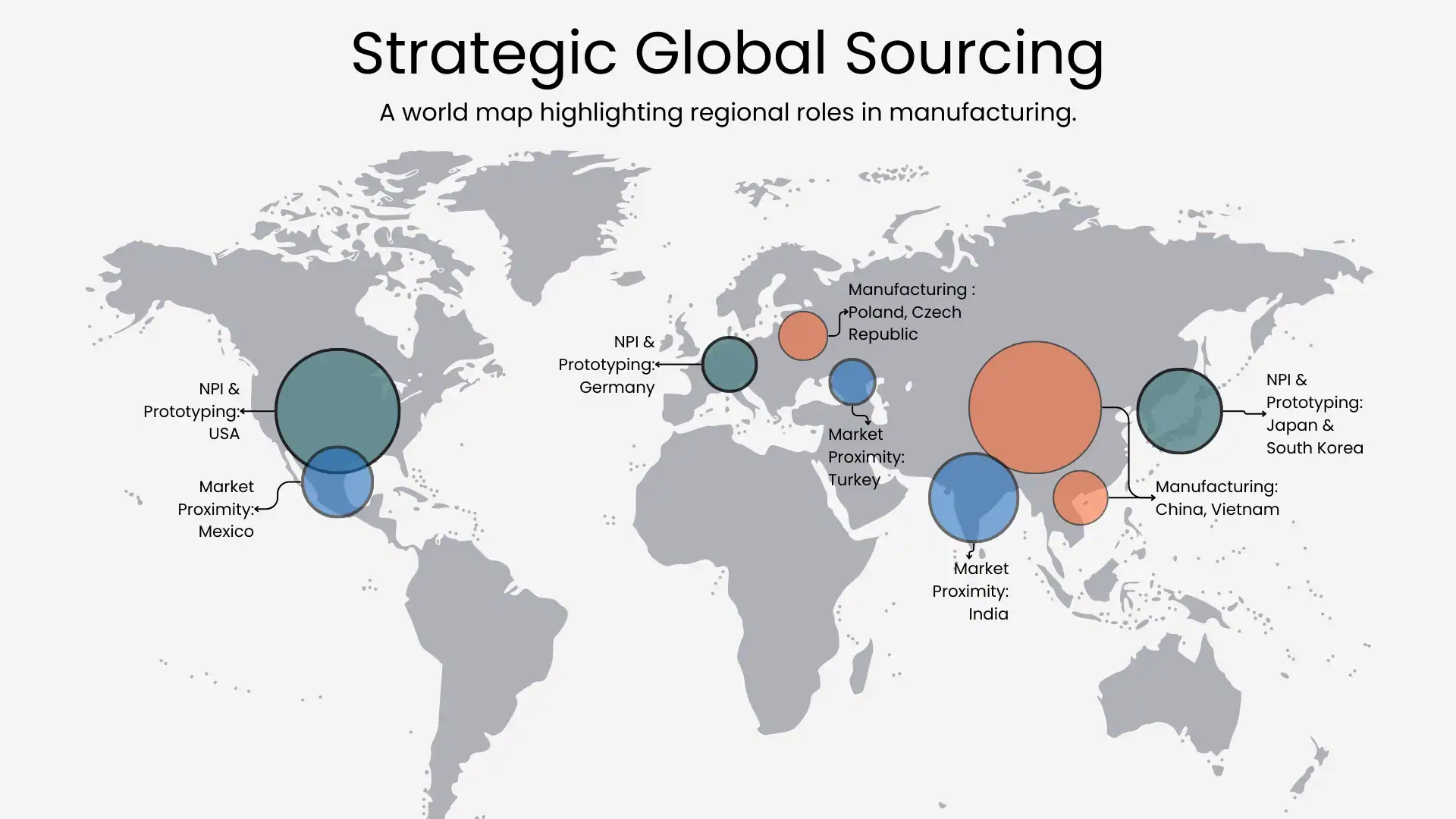

High-performing sourcing strategies distribute capability across regions rather than stacking everything in one place. Each region plays a different role based on scale, capability, cost structure, and proximity to customers.

Done properly, this allows companies to:

- Balance high-volume efficiency with regional responsiveness

- Reduce risk without duplicating entire supply chains

- Shift volumes as conditions change without restarting qualification processes

The key word here is intentional.

This model evolves with the business rather than being inherited from decisions made ten years ago under very different conditions.

A major OECD analysis found that suboptimal diversification is now 50% more common in the 2020s than in the late 1990s, reflecting increased exposure to shocks.

Where Most Strategies Break: New Product Introduction

If global sourcing is going to fail, it usually fails at NPI.

When sourcing decisions are made late, after designs are locked and timelines fixed, the same problems show up every time: cost creep, delayed launches, and limited scalability. Tooling risks, localisation headaches, and ramp-up constraints appear when flexibility is already gone.

Strategic global sourcing addresses this by engaging early.

Manufacturing feasibility, regional options, and future scalability are considered alongside product requirements, not after them. Early alignment reduces late-stage risk, shortens time to volume, and creates optionality as products move from prototype to mass production.

Optionality beats heroics. Every time.

Competitive Advantage Comes from Optionality

The true value of strategic global sourcing isn’t just lower cost. It’s choice.

Rather than being locked into a single region, supplier, or cost structure, companies gain the ability to adapt. Volumes can shift. Markets can be served locally. Disruption can be absorbed without emergency air freight and panicked board calls.

Cost discipline still matters. Strategic sourcing doesn’t abandon efficiency. It just refuses to sacrifice continuity and growth to chase short-term savings.

Over time, that flexibility compounds. Companies built this way move faster, scale with more confidence, and outperform competitors trapped in rigid, cost-only sourcing models.

“Products can be easily copied. But a supply chain can provide a true competitive advantage.”

— Yossi Sheffi, supply-chain expert

Strategy Over Geography

Strategic global sourcing is not about finding the ‘right’ country. It is about building the right sourcing system.

In a volatile world, competitive advantage doesn’t come from being cheapest this quarter. It comes from being adaptable, resilient, and aligned with where the business is heading next.

Companies that treat sourcing as a strategic capability are not just managing risk. They are positioning themselves to compete more effectively, today and in the future.

Explore more related content

Critical Minerals, Critical Thinking: Building Resilient Electronics Supply Chains

Critical Minerals, Critical Thinking: Building Resilient Electronics Supply ChainsThe global economy is expected to...

Cybersecurity for Smart Factories: A 2025 Playbook for OT Resilience

Cybersecurity for Smart Factories: A 2025 Playbook for OT ResilienceWhy "smart" now means "secure" or not at all Smart...

Digital Product Passports for Small Appliances & Air Purifiers

Digital Product Passports for Small Appliances & Air Purifiers: A 2025–2027 Manufacturer Playbook From the Oxera...