Critical Minerals, Critical Thinking: Building Resilient Electronics Supply Chains

The global economy is expected to use four times the current amount of critical minerals by 2040 to support clean energy, transport electrification and industrial decarbonization. -World Bank

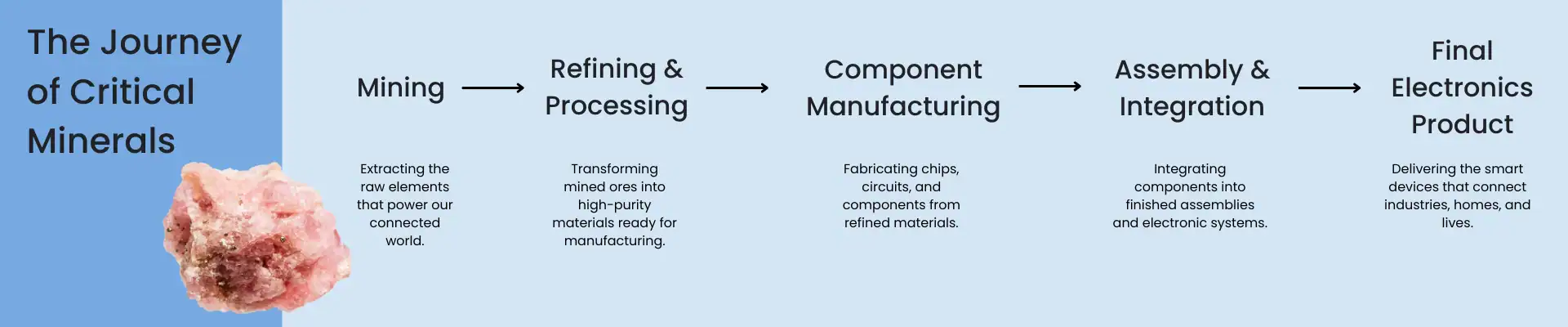

In the world of electronics manufacturing, the story seldom starts in a cleanroom. It begins deep underground – in mines, refineries and smelters processing obscure elements like gallium, graphite, tungsten, and lithium. These are the “critical minerals” modern devices, smart manufacturing, and supply-chain agility depend on. But beneath the surface, there’s a far more profound challenge: a global sourcing that is hugely concentrated, vulnerable, and increasingly shaped by geopolitics. If you’re a contract manufacturer, OEM, or supply-chain engineer, this is one story you can’t afford to overlook.

Why “Critical Minerals” Matter in Electronics

The term critical minerals encompasses raw materials, which are of high economic importance while simultaneously being susceptible to significant supply risk.

In electronics, these minerals show up in surprising places, which include lithium in battery packs, graphite in anodes, gallium and germanium in semiconductors, tungsten in assembly, and rare earths in magnets. Even a smartphone may contain fifty or more different metals.

Take lithium demand: according to the International Energy Agency, lithium demand went up nearly 30 % in 2024 far above the ~10 % rate of the 2010s.

Graphite and cobalt grew similarly at 6-8%. Because these minerals form the backbone of everything from battery packs to high-performance CPUs and power electronics, any disruption to their sourcing directly translates into a risk for manufacturing throughput, cost control, and delivery schedules.

The Single-Point-of-Failure Problem in Material Sourcing

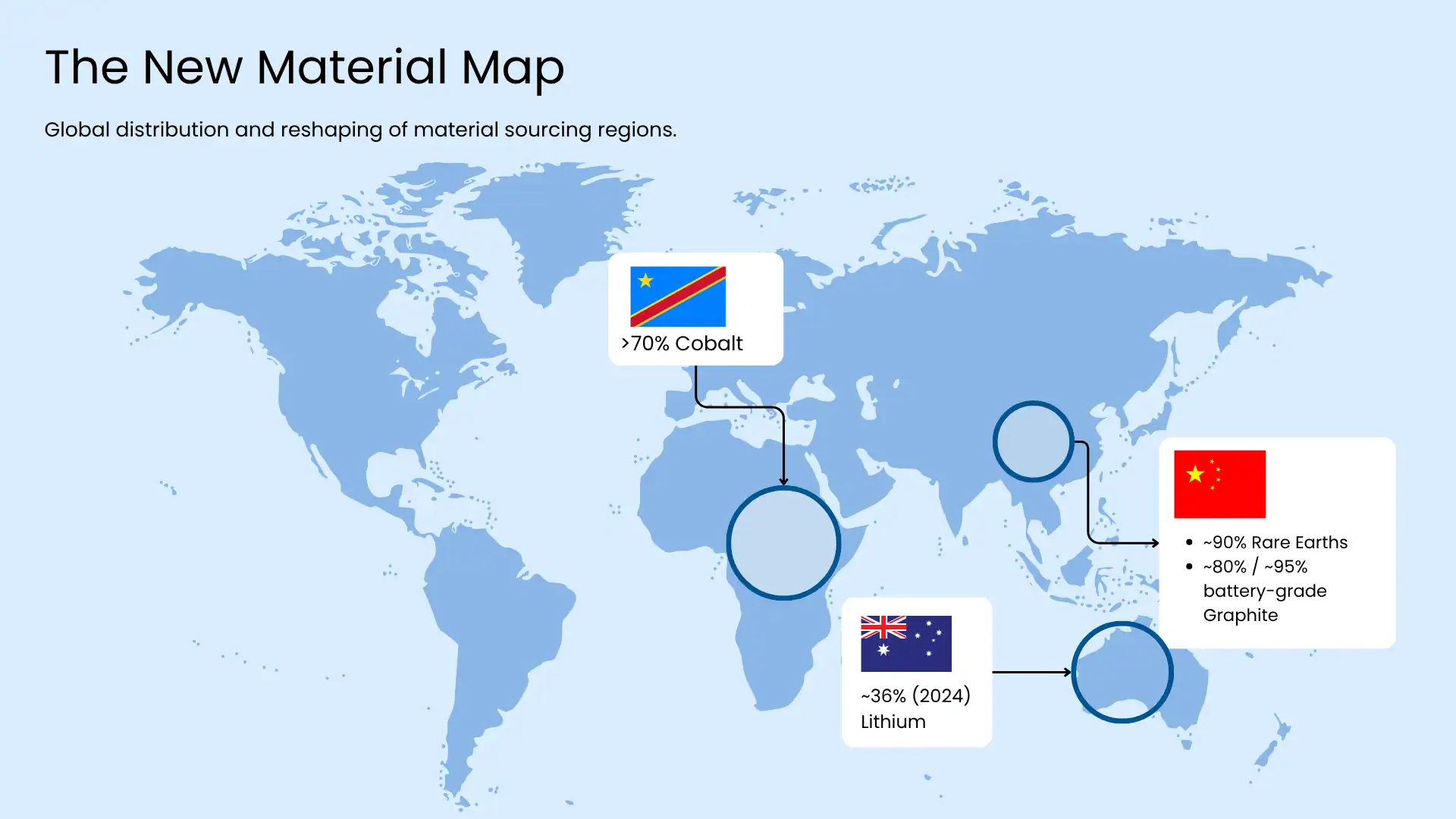

That is where things get fragile: the sourcing of many of those critical minerals is extremely concentrated. For instance, rare earth element mining and refining remains dominated by a handful of countries.

According to studies undertaken by the European Union, dependency for some materials on a single third-country supplier approaches 100 % at certain processing stages.

Why does this matter? When you’re designing electronics manufacturing operations at your OEM, you assume dual sourcing, component lead-time buffers, alternative alloys. But when the upstream mine and refinery sit in one region-and logistics, permitting, or trade policy changes-then the “just-in-time” model cracks.

For instance, the UK’s Task & Finish Group on Industry Resilience for Critical Minerals warns that mineral-reliant industries like electronics face “key points of tension that could lead to instability and disruption”.

The report of the Cambridge IfM workshop also underlines that building resilience in critical mineral supply chains is industrial strategy.

The electronics industry is moving quickly to adapt and reinvent itself for a bright future. Global supply chain risks associated with underlying materials apply to all of society’s technologies due to the pervasiveness of electronic systems across every industrial vertical.” — National Academy of Engineering article

Geopolitical Shifts: The Sub-Focus that Matters

So far so technical. Now for the geopolitical under-current. Countries are no longer just miners and refiners, they’re strategic players. A clear signal is the European Critical Raw Materials Act, or CRMA: the EU wants by 2030 to extract 10 % of its annual strategic raw-material needs domestically, process 40 % and recycle 25 %.

It also establishes a target stating that no single third country should supply more than 65% of the EU’s annual demand for a strategic material at any processing stage.

What this means: sourcing strategies are shifting. “Friend-shoring”, diversification, build-out of regional capacity, these are not buzzwords, they are industrial moves. For the manufacturing and supply-chain lead, the takeaway is simple: upstream matters. Where you mine, refine, transport and process impacts your downstream operations.

There’s also fragility in the geopolitics: export restrictions, trade policy changes, permitting delays in mineral-rich countries, ESG and community issues at mining sites, all of which can ripple into manufacturing.

In the EU in 2024, for rare‐earth elements (REE+), the largest partner for imports was China (46 %), followed by Russia (28 %) and Malaysia (20 %), and the share of the top-3 importers for many items exceeded 90 %.

How Manufacturers Can Engineer Flexibility

Alright, enough risk. What’s the solution roadmap? For electronics manufacturers and contract manufacturers, engineering supply-chain flexibility becomes a competitive differentiator. Here are four actionable levers:

- Qualify multiple suppliers early. Do not rely on one refinery or smelter. Add in alternate materials or sourcing regions – whether Spain, Eastern Europe, Australia, Canada or Southeast Asia.

- Research other alloys or composites. As an example, engineers are investigating interconnect metals beyond those traditionally considered critical. Ti, Al, Ni, Mo have favourable sustainability/security profiles in one recent study.

- Create traceability and transparency by instituting blockchain-enabled sourcing logs, digital twins of material flow, and material passports-so if a disruption occurs, it is immediately clear where your upstream materials are at risk.

- Embrace circularity: Recycling, reuse and design for disassembly reduce dependence on virgin mining. The CRMA sets a target of 25 % recycling for strategic raw materials in the EU.

Designing electronic modules for serviceability-removable and replaceable batteries, upgradeable modules, etc-isn’t just good for sustainability; it’s also materials risk management.

Global demand for critical minerals is surging, driven by the rapid shift towards clean energy and advanced digital technologies … but meeting this demand requires diverse, responsible, and resilient value chains.

Technology & Visibility: The Smart-Manufacturing Edge

It’s worth noting how digital technology is supporting this shift in materials.

- AI-driven sourcing optimization: predictive analytics flags when a smelter outage or an export control event could impact your supply chain.

- Digital twins of supply-chain networks: simulate alternate sourcing paths, cost impacts, and lead-time shocks.

- Material passports/Blockchain traceability: create verifiable history of origin of critical minerals; relevant for clients with ESG requirements and regulatory disclosures.

- Modular manufacturing architecture: By designing product platforms that can switch to alternate material stacks or suppliers, you reduce redesign cycles when sourcing changes.

Materials Are the New Manufacturing Frontier

The battleground isn’t just the device in electronics manufacturing today; it’s the material. The next generation of OEMs, smart-plants, and contract manufacturers will win or lose on how agile their material-sourcing ecosystem is-mining to module, global to local, linear to circular.

Explore more related content

Strategic Global Sourcing: How Companies Move from Cost Saving to Competitive Advantage

Strategic Global Sourcing: How Companies Move from Cost Saving to Competitive AdvantageSupply chain disruptions now...

Cybersecurity for Smart Factories: A 2025 Playbook for OT Resilience

Cybersecurity for Smart Factories: A 2025 Playbook for OT ResilienceWhy "smart" now means "secure" or not at all Smart...

Digital Product Passports for Small Appliances & Air Purifiers

Digital Product Passports for Small Appliances & Air Purifiers: A 2025–2027 Manufacturer Playbook From the Oxera...