AI-Powered Robotics in Automotive: The Manufacturing Advantage No One Can Ignore

“Dig into every industry, and you’ll find AI changing the nature of work.”

— Daniela Rus, Director of MIT’s Computer Science and Artificial Intelligence Laboratory

ADAS takes all the credit. But come on — before your ADAS module can detect a pedestrian, it has to be fitted perfectly, bonded to spec, and tested to a level of thoroughness.

While the company focuses on the front of AI — autonomous, predictive maintenance, routing optimization — the real bottle neck is occurring behind the scenes: making the advanced hardware that allows for advanced vehicles to be possible.

This is where AI-powered robots are stealthily transforming the way automobiles — especially EVs — are built.

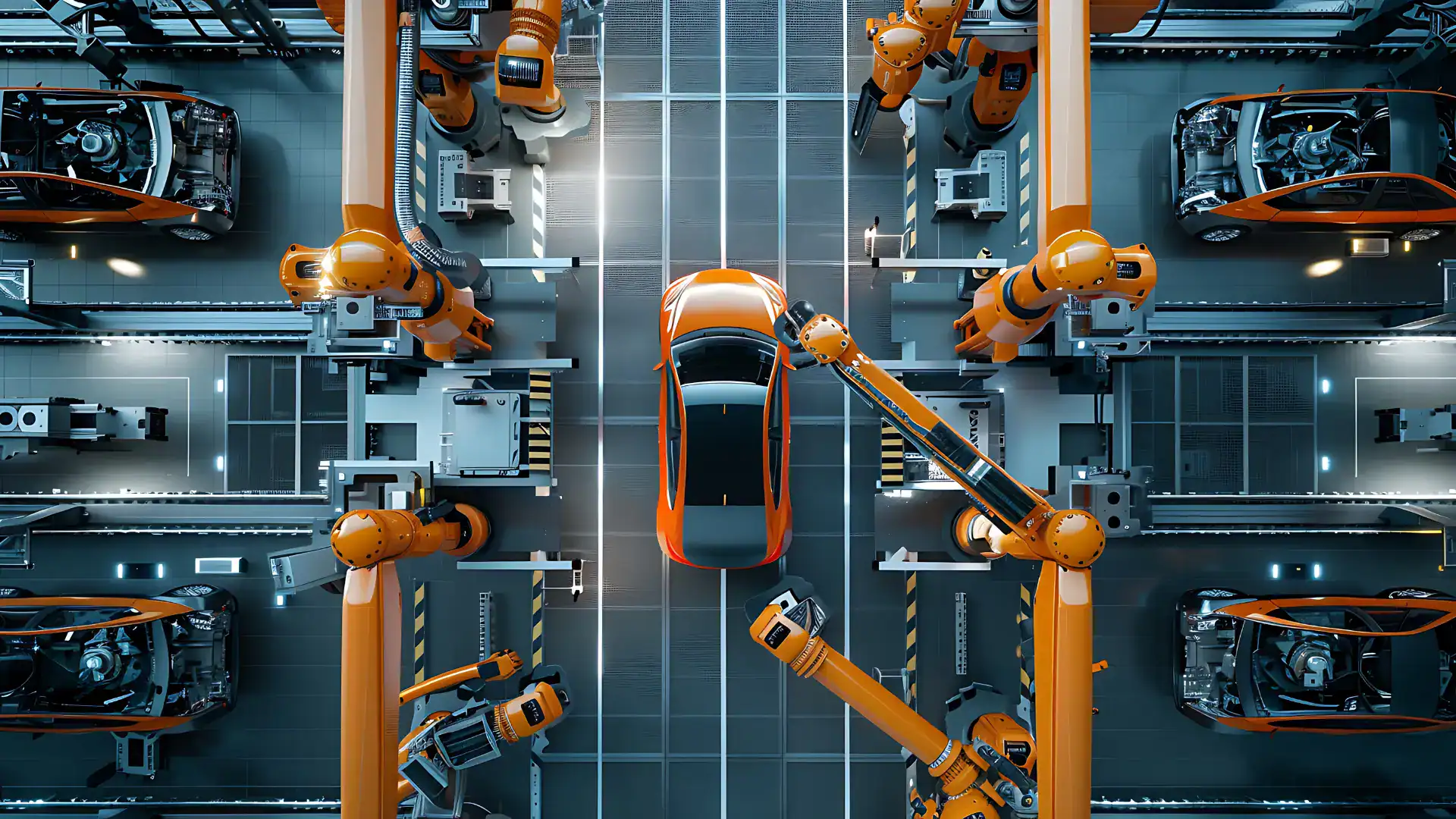

The Shift: From Fixed Automation to Intelligent Assembly

For decades, automation at car factories meant just one thing: program-controlled robots carrying out a single repetitive task with little room for variation. Weld in this location. Pick up that one. Insert part A into slot B. It functioned — if parts were ideal and procedures were unchanging.

That’s no longer the reality auto engineers inhabit, however.

The way it is today:

- EVs introduce multi-material structures, high-density battery packs, and high-voltage modules.

- Globalized sourcing means more variability in suppliers and tighter part stacking tolerances.

- Model mix increases — the same line is making five different models in a given day.

Traditional automation in this environment becomes brittle. Reprogramming robots for every slight variation slows output and increases downtime.(Reference: IBM: The Rise of Robotics in the Auto Industry)

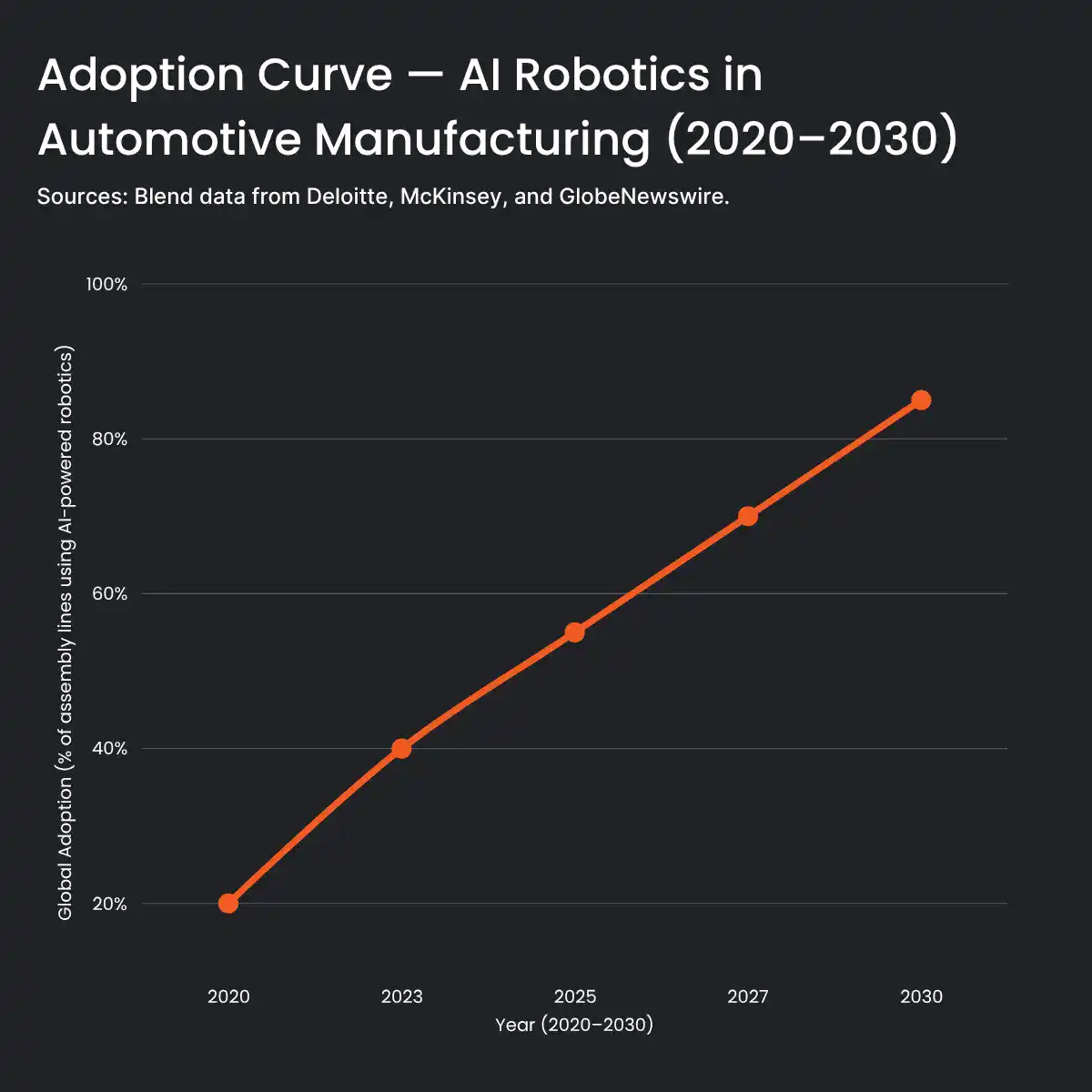

By 2025, AI in the manufacturing market is projected to reach $8.57 billion, up from $5.94 billion in 2024, reflecting a CAGR of 44.2%.

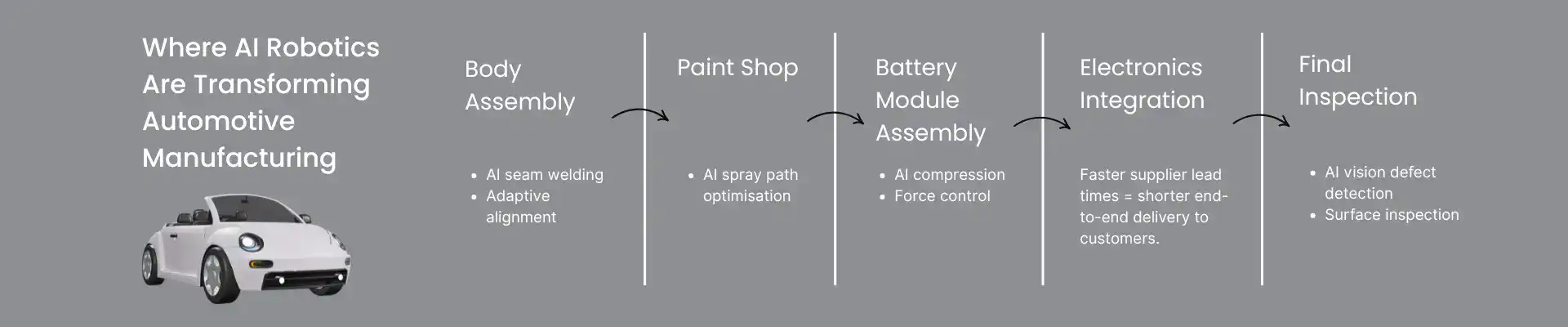

Where AI Robotics Are Already Delivering

AI-powered robots are not merely “more automation.” They bring a level of perception, anticipation, and responsiveness to manufacturing that revolutionizes factory operations. And it’s already happening at several key manufacturing steps:

- Welding & Joining:

AI-powered vision systems constantly monitor seam position and material deviation. Instead of waiting for post-process inspection, they adjust parameters in real time — avoiding most of the weld flaws that previously made it down the line. - EV Battery Assembly:

The precision demands of cell placement, compression bonding, and thermal management are stringent. AI-powered robots dynamically control force, angle, and speed for each battery module — materially reducing reject rates. - Adaptive Paint & Coatings:

AI vision reacts to spray patterns for small movement of parts, panel shape, and surface conditioning — producing improved finish quality with reduced waste. - Inline Defect Detection:

AI vision with high resolution can see microscopic defects invisible to standard sensors: surface microcracks, adhesive gaps, weld porosity, panel misalignment — all inline detected, not end-of-line. - Human-Robot Collaboration (HRC):

AI-powered forcetorque sensors allow co-bots to work alongside humans securely, handling oversized modules like instrument panels or battery trays with force controlled in a predictable manner.

The U.S. automotive robotics industry is projected to reach $8.28 billion by 2033, driven by a CAGR of 10.74% from 2025 to 2033.

Why Traditional Automation Can’t Keep Up with EV Complexity

The shift to EVs hasn’t just changed drivetrain layouts — it’s rewritten the rulebook for manufacturing. Larger battery packs, heavier vehicle bodies, multi-material frames, and far more electrical integration have exposed the limits of conventional robotics.

Why? Because in highly modular EV platforms:

- Tolerance stacking compounds fast.

- Small supplier variations become big fit-up issues.

- Heavier, high-voltage modules demand high-precision, force-controlled handling.

- Model mixes change daily, not monthly.

( Reference: Just Auto Magazine: Applications of Robotics in the Automotive Industry)

AI-powered robotics allow assembly lines to absorb these natural variances dynamically.

Smart Manufacturing Is Now the Competitive Advantage

As a supplier deeply involved in this space, we’re seeing that manufacturing flexibility has become part of the engineering spec.

It’s not just about robots running programs. It’s about embedding intelligence into every step:

- Adaptive vision systems guiding part placement

- Predictive QA using in-line data streams

- Closed-loop process adjustments based on live defect rates

- Digital twins driving preventive maintenance and real-time correction

In short, your manufacturing line evolves from being fixed to being self-correcting — a massive leap for first-pass yield and stability.

AI-driven automation could reduce operational costs by 20–30% while increasing production output by 10–15%

Why the Pressure Is Rising

Global investments are rapidly raising the stakes. The UAE–US $1.4 trillion AI deal, including massive orders of Nvidia hardware, is just one signal of how AI investment is no longer limited to software companies.

At the same time:

- The CHIPS Act is driving domestic capacity in the U.S.

- The EU Chips Joint Undertaking is investing heavily into backend packaging and AI hardware assembly.

- China is pushing for AI manufacturing self-sufficiency at every level.

The race to build AI-powered systems is on — and the manufacturing capacity to support it is under heavy strain, not just in wafer fabs, but in backend assembly lines where automotive and hardware ecosystems collide.

(Reference: GlobeNewswire: United States Automotive Robotics Industry Report 2025)

OEMs are no longer just buying parts — they’re buying process stability all the way down the supply chain.

The Metrics Driving Adoption

Why are manufacturers moving fast? Because the numbers speak for themselves:

- 50% defect rate reduction in AI-powered weld QA (McKinsey)

- 20–40% productivity gains in EV battery module assembly (Deloitte)

- Up to 30% scrap cost savings using ML-driven inline inspection (Nvidia pilots)

In an industry that operates on razor-thin margins, these aren’t incremental improvements — they’re program-winning advantages.

What Engineering & Procurement Teams Should Be Asking

For OEM platform leaders, sourcing managers, and engineers, the questions are shifting:

Are suppliers using AI to automate robot assembly lines?

- Is QA occurring at build time — or downstream?

- Are robotic systems set up to accommodate variant production without reprogramming?

- Can traceability systems offer real-time defect mapping for regulatory compliance?

The companies that answer ‘yes’ will dominate future automotive platforms.

“AI is a mirror, reflecting not only our intellect but our values and fears.”

— Ravi Narayanan, VP of Insights and Analytics, Nisum

The Bottom Line: AI Robotics Aren’t the Future — They’re Already Here

AI-powered robotics are not replacing humans. They’re replacing rework, inconsistency, and waste.

In automotive manufacturing, where design cycles are compressing and model variety keeps growing, adaptive manufacturing is no longer optional.

The OEMs and suppliers who scale these systems will own the next decade of automotive manufacturing.

Explore more related content

Strategic Global Sourcing: How Companies Move from Cost Saving to Competitive Advantage

Strategic Global Sourcing: How Companies Move from Cost Saving to Competitive AdvantageSupply chain disruptions now...

Agentic AI in Manufacturing: Why 2026 Is the Year AI Finally Starts Doing the Work

Agentic AI in Manufacturing: Why 2026 Is the Year AI Finally Starts Doing the WorkThe global AI in manufacturing...

Critical Minerals, Critical Thinking: Building Resilient Electronics Supply Chains

Critical Minerals, Critical Thinking: Building Resilient Electronics Supply ChainsThe global economy is expected to...