ROI in Sustainable Manufacturing:

Why Manufacturers are Betting on Carbon Reduction for Real Returns

By 2026, more than 50% of global product-based companies will have formal carbon intelligence programs in place, linking emissions data directly to procurement and manufacturing decisions.

— Gartner, “Top Trends in Supply Chain Sustainability” (2023)

Now? It’s on the P&L.

Today’s manufacturing leaders are no longer asking if they should decarbonise. They’re asking how soon the investment will pay off. And the answer, increasingly, is: sooner than you think.

With rising energy costs, tightening ESG expectations, and customers demanding cleaner supply chains, low-carbon manufacturing isn’t just a climate win. It’s a business strategy. This article breaks down how to calculate the return on those investments, because green is great, but green with ROI is what keeps the board listening.

Two-thirds of sustainability investments have a positive ROI within three years, particularly those targeting energy efficiency and process optimisation.

— Boston Consulting Group, “The Economic Case for Sustainability” (2023)

Emissions Are Now Measured in Dollars, Not Just Tonnes

If you’re still treating carbon like an abstract metric buried in an annual report, it’s time for a reality check.

Governments are attaching real costs to emissions via taxes, trading schemes, and penalties and buyers are attaching real consequences. In 2024, McKinsey warned that manufacturers delaying decarbonisation could lose up to 20% of EBITDA by 2030. Why? Compliance costs, lost contracts, and an energy bill that’s allergic to stability.

Scope 3 requirements are table stakes in global procurement today. If your factory can’t measure emissions data or show a path to reduction, don’t anticipate that RFQ coming back.

ROI on Decreasing Carbon: Where the Money Actually Isn’t

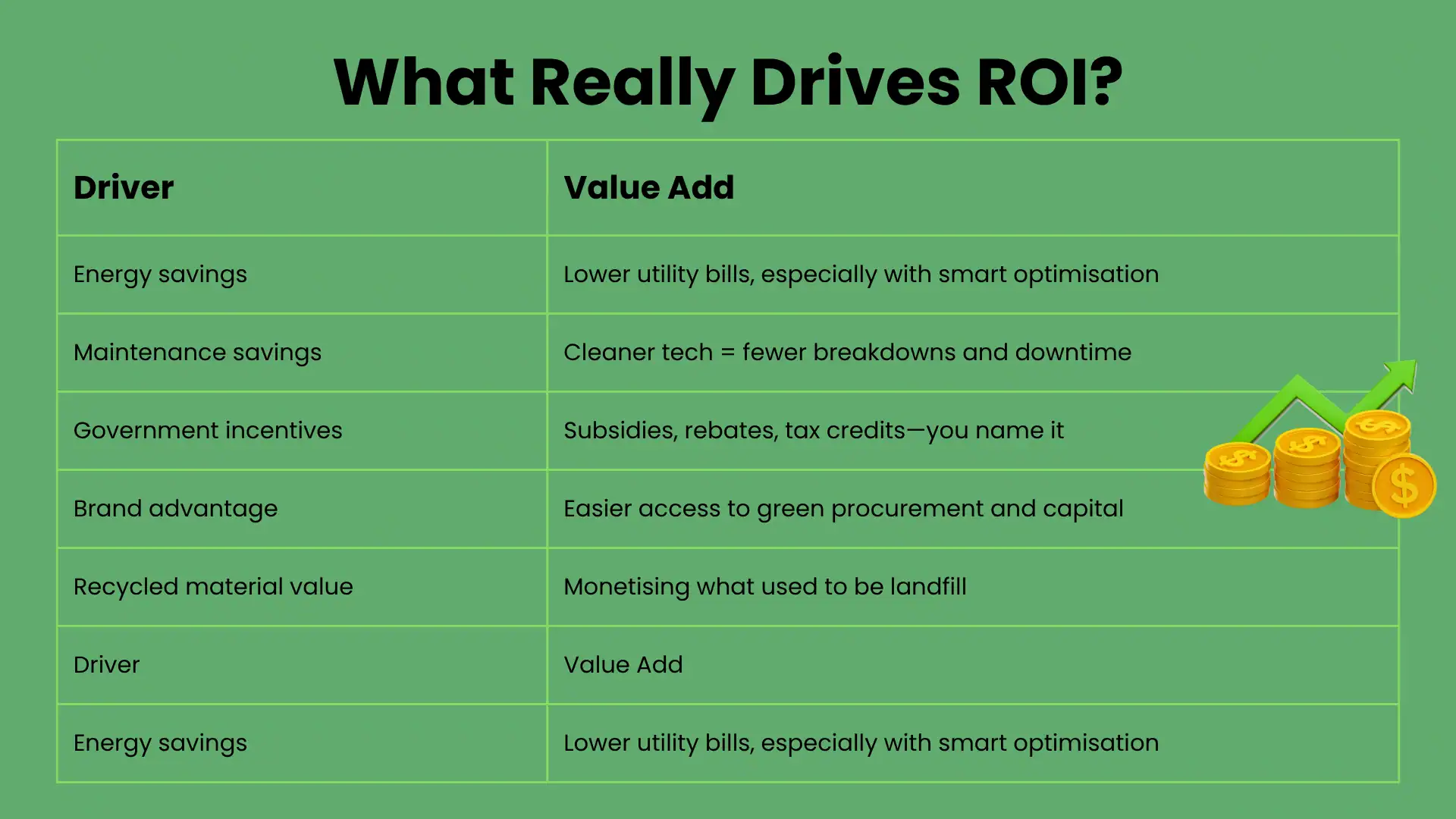

Sustainability isn’t required to hide behind warm fuzzies and glossy reports. When done correctly, it creates numbers even your CFO adores.

Quick Formula

ROI (%) = [(Annual Savings + Incentives – Annualised CAPEX) / Annualised CAPEX] x 100

Consider a $500,000 heat recovery system. If it saves $120,000 annually and earns a $100,000 incentive, that’s a 40%+ return on investment with a five-year-or-less payback. Go ahead and try to find a machine tool that pays for itself that fast.

Green CAPEX: The Kind of Investment That Doesn’t Sit Idle

Welcome to the age of Green CAPEX, where you invest in technology that makes your plant more efficient, cleaner, and, yes, smarter.

This’s not about putting solar panels on the roof and holding out for the headlines. We’re talking about capital investments that reduce emissions and operating costs. It’s sustainability with an Excel spreadsheet.

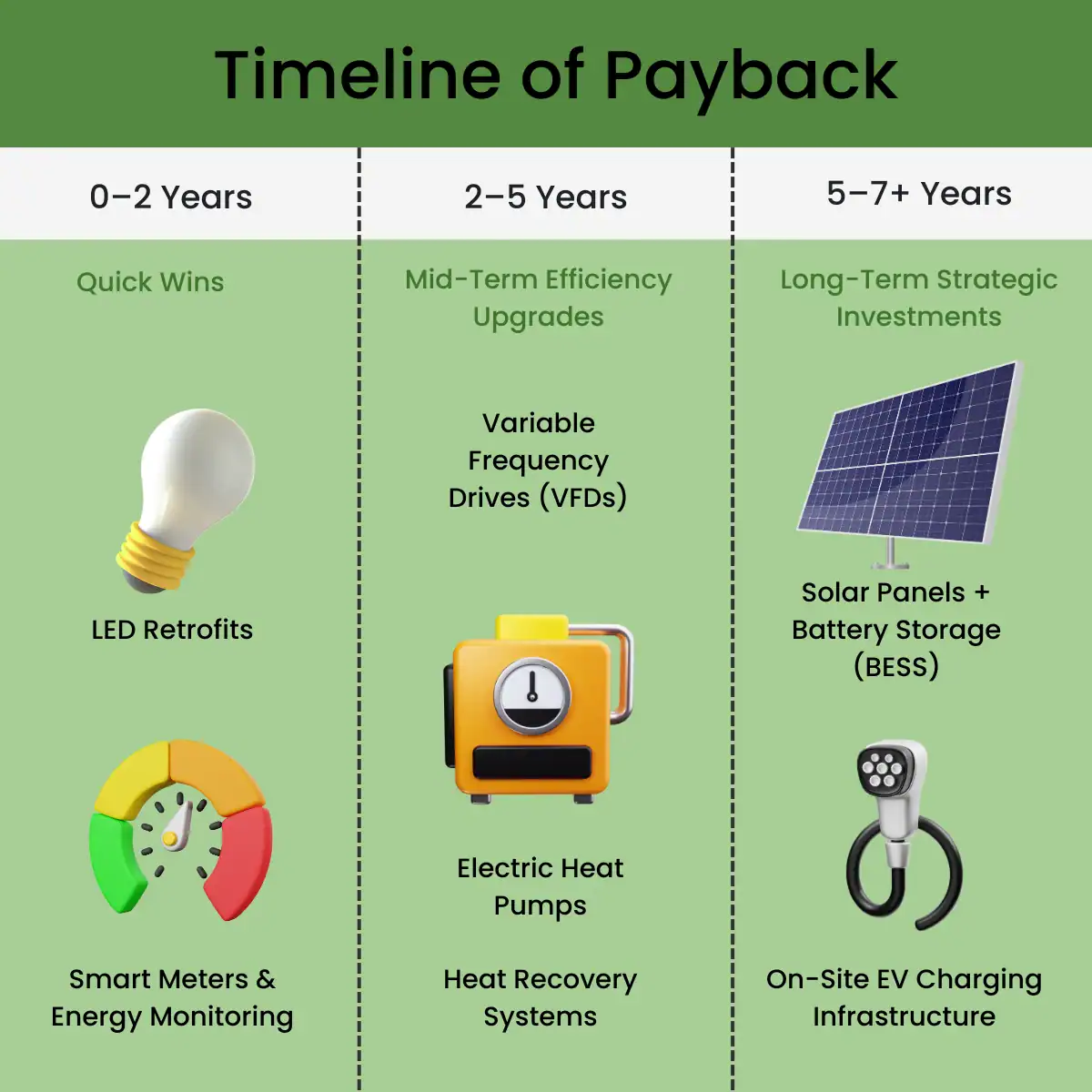

High-Impact Examples

- Variable Frequency Drives (VFDs): Up to 30% less energy wasted by motors

- Electric heat pumps: Next-generation alternatives to fossil fuel boilers

- LED + smart lighting: 50–70% lower lighting energy costs, quick payback

- Solar with BESS: Grid independence, minimized Scope 2 emissions, less peak-hour shock

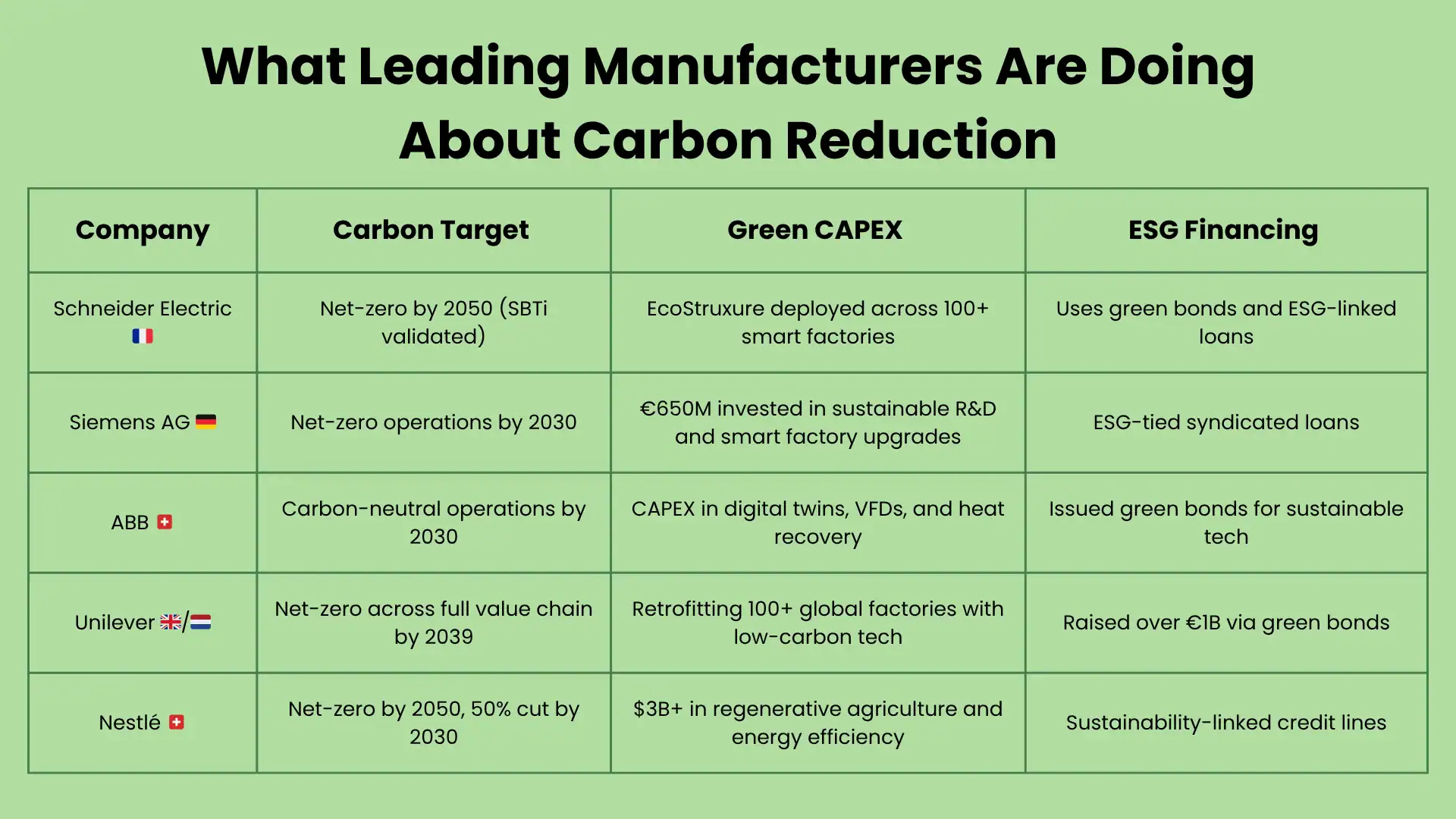

Software like Schneider’s EcoStruxure or Siemens’ TIA Portal now integrate energy and sustainability KPIs into real-time dashboards. No more wondering what does work and what doesn’t.

Manufacturers that embed sustainability into capital allocation achieve 20–25% higher asset productivity over time.

— World Economic Forum & Accenture, “Global Lighthouse Network” (2023)

Soft Returns, Hard Impact

All that matters doesn’t necessarily show up in the line item of a bill. But that doesn’t make it worth any less.

What Else Comes with Going Low-Carbon?

- Preferred supplier status: Cleaner ops = more RFQs from brands with net-zero targets

- Top talent magnet: Engineers want to work for companies doing more than lip service

- Green capital access: ESG loans, grants, and sustainability-linked bonds are multiplying

- Resilience points: Fewer budget shocks, less volatility in energy markets

These “soft” wins make your business more future-proof. They also give your competitors the jitters.

Over 70% of institutional investors consider a company’s climate strategy when allocating capital. Firms with strong ESG performance enjoy a lower cost of capital.

CDP & Harvard Business Review, “The Financial Impact of ESG” (2021)

Making the Case Internally: Use ROI, Not Idealism

When presenting a pitch for a green upgrade to your board or procurement department, don’t bore them with polar bears. Explain it in terms of performance.

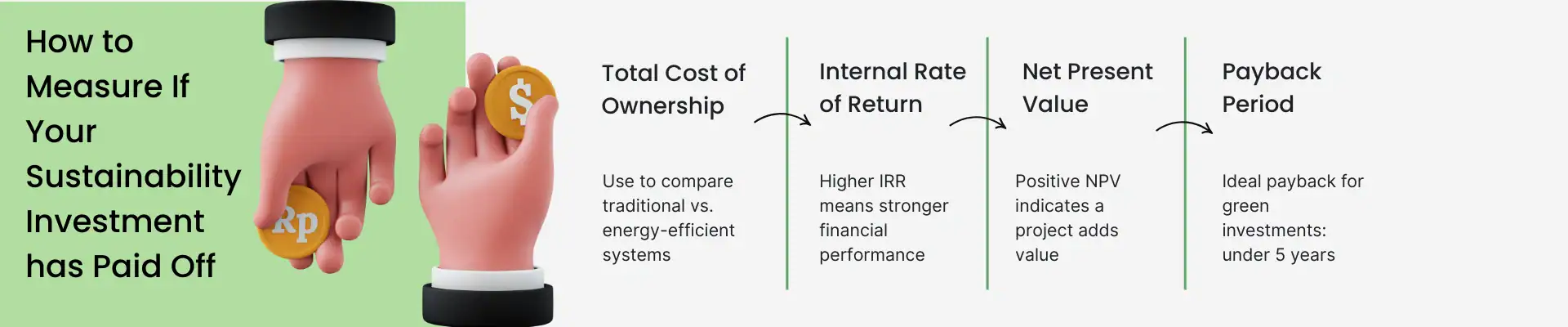

Speak their language, cost, cashflow, compliance, and competitiveness. Draw parallels between sustainability investments and traditional CAPEX based on payback and IRR. Emphasize risk reduction. And wherever applicable, demonstrate rather than explain.

Utilize Tools Such As:

- DOE’s EnPI for energy savings at the facility level

- GHG Protocol tools for Scope 1, 2, 3 accounting

- Rockwell’s Energy ROI Estimator

- SBTi goals and CDP benchmarks for outside verification

Competing on peers is also effective. If your peers are seeing declines and securing green financing, lagging behind is expensive.

Every dollar invested in energy efficiency generates $2–$4 in economic return. The returns aren’t just financial, they’re operational.

— International Energy Agency, “Energy Efficiency 2022”

Low-Carbon Isn’t a Cost, It’s a Competitive Advantage

Manufacturers who leverage sustainability as a profit driver, not a PR gimmick; are already enjoying benefits in energy savings, talent retention, and customer loyalty. The earlier you translate carbon data into action, the earlier you head the pack.

Decarbonisation is no longer a side project. It’s the way producers stay relevant, resilient, and profitable in an only greening environment.

TLDR Summary

- Green investments like energy retrofits and emissions-reducing equipment can pay back 30–50% ROI

- Soft wins like better funding and supply access reinforce long-term value

- Use CAPEX metrics like IRR, NPV, and TCO to gain internal buy-in

Low-carbon and high-performance are no longer competing goals, as exemplified by companies like Schneider, Siemens, and ABB.

Explore more related content

Critical Minerals, Critical Thinking: Building Resilient Electronics Supply Chains

Critical Minerals, Critical Thinking: Building Resilient Electronics Supply ChainsThe global economy is expected to...

Cybersecurity for Smart Factories: A 2025 Playbook for OT Resilience

Cybersecurity for Smart Factories: A 2025 Playbook for OT ResilienceWhy "smart" now means "secure" or not at all Smart...

Digital Product Passports for Small Appliances & Air Purifiers

Digital Product Passports for Small Appliances & Air Purifiers: A 2025–2027 Manufacturer Playbook From the Oxera...