Inshoring in the USA: The Industries That Are Bringing Manufacturing Back Home

76% of American consumers say they are willing to pay more for domestically produced goods, particularly in food, electronics, and automotive sectors. (Source: National Retail Federation, 2025)

But why is this happening now? And which industries stand to gain the most? Let’s break it down.

Tidal Shifts Happening Right now

Recent trends following the 2024 U.S. election show a significant push for inshoring. For example, Apple has announced a $500 billion investment plan, including a new AI server factory in Texas and 20,000 R&D jobs (source). Additionally, the United Auto Workers president has voiced support for tariffs on foreign-made cars to boost domestic manufacturing. These developments align with broader policy efforts to strengthen U.S. industry.

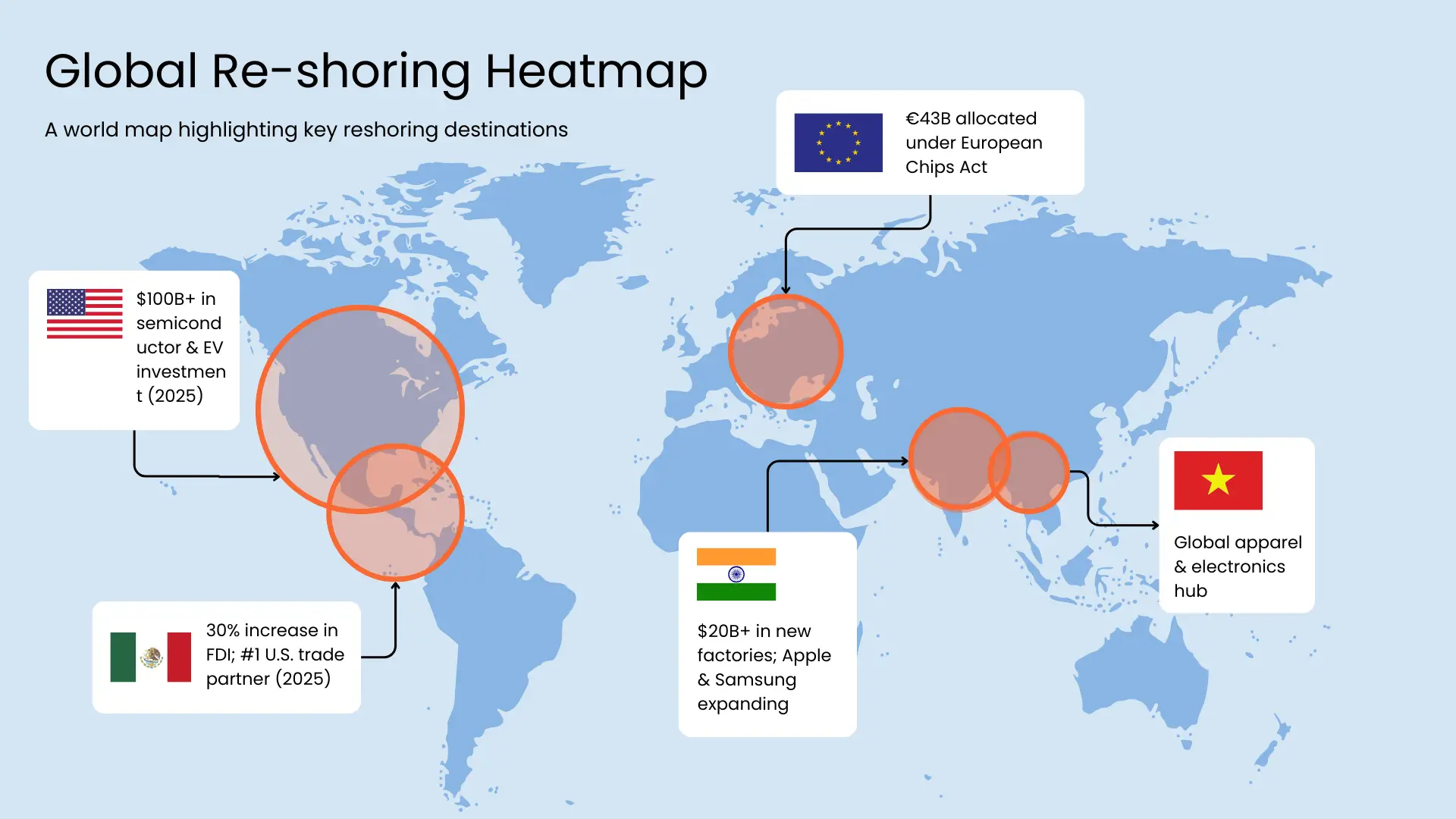

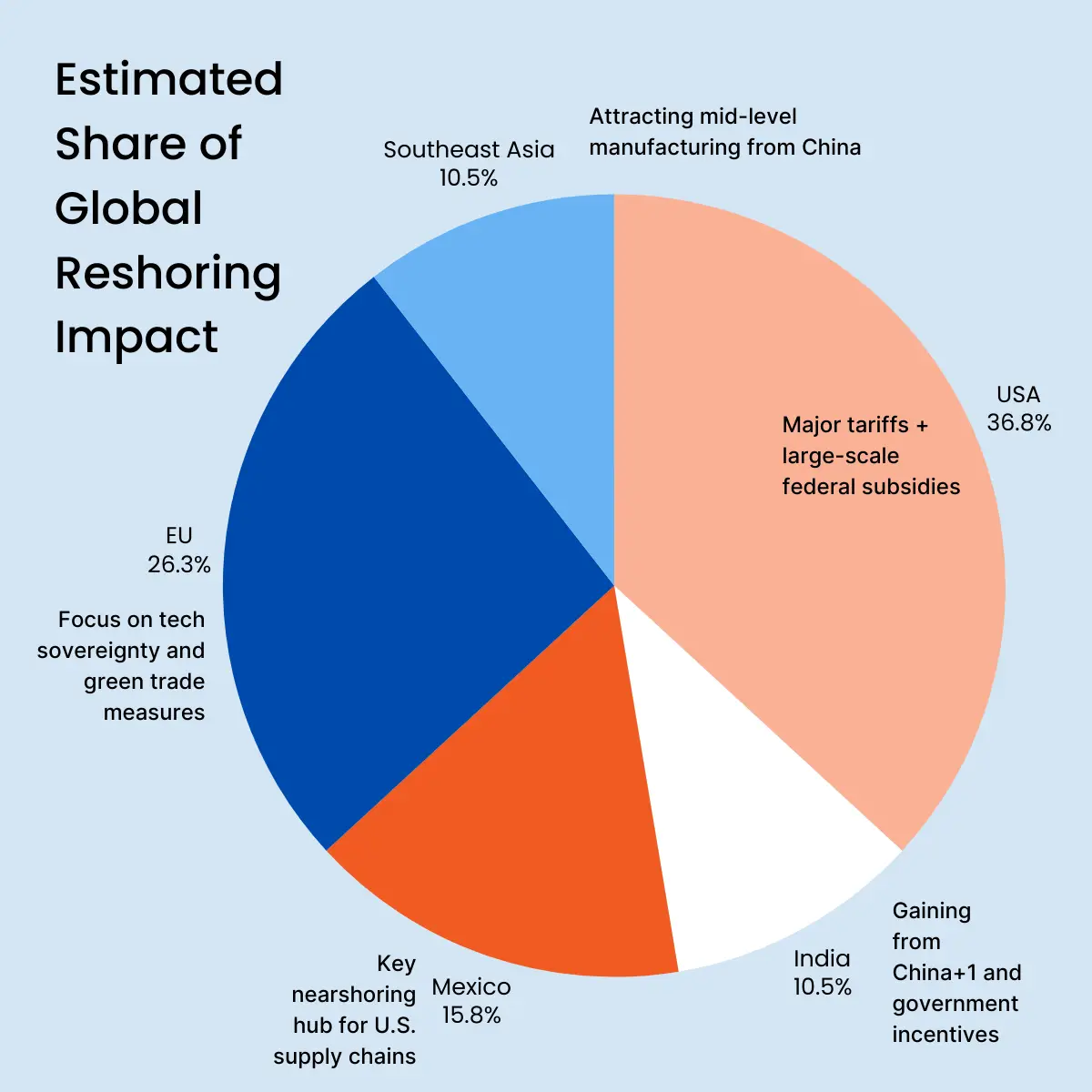

Changes in U.S. foreign and trade policy, the global trade tensions, and growing concerns around national security in the USA have all fuelled a shift toward domestic manufacturing.But beyond policy, inshoring is also a business resilience strategy. By controlling more of their supply chain domestically, companies gain agility, reduce risk, and respond faster to market changes.

Since 2023, over $500 billion in new tariffs have been imposed worldwide, impacting industries from electronics to automotive and accelerating supply chain diversification.(Source: WTO, 2025)

Why Inshoring Is Accelerating in 2025

- Tariffs & Trade Policies:

Global patterns of tariffs have recently shifted, making imports more expensive, particularly in high-technology and industrial sectors. The U.S. has increased tariffs on big imports from different regions, particularly in pharmaceuticals and semiconductors, to strengthen domestic supply chains. - Supply Chain Resilience:

The recent years have exemplified the vulnerabilities of global supply chains. Amidst logistics disruptions and geopolitical tensions, organizations are reducing reliance on overseas manufacturing to ensure production stability. - Government Incentives:

Policymakers have implemented policies like the CHIPS and Science Act and the Inflation Reduction Act offering massive tax credits and grants to organizations investing in U.S. manufacturing, particularly in semiconductors, EVs, and green technology. - Consumer & Market Trends:

Rising demand for “Made in USA” products, especially in upscale manufacture and national security-related industries. American consumers increasingly care about ethical supply chain sourcing, quality assurance, and sustainability.

The question isn’t just whether inshoring makes sense—it’s where it makes the biggest impact.

Top 10 Industries by Inshoring Potential

Although some industries are better suited for reshoring than others, these are the sectors seeing the greatest return to the U.S. in 2025:

Agricultural Products – 95-100%

Food & Beverage Manufacturing – 80-90%

Construction Materials – 70-85%

Automotive Manufacturing (Final Assembly) – 50-60%

Medical Devices – 40-50%

Pharmaceuticals (Essential Drugs) – 30-45%

Garments & Apparel (Niche/High-End) – 25-35%

Semiconductors (Manufacturing Only) – 20-30%

Industrial Machinery & Tools – 15-25%

Consumer Electronics – 10-20%

Those sectors that have a high level of federal support, access to raw materials, or national security status are leading the reshoring drive.

We are witnessing a once-in-a-generation realignment of global supply chains. Companies are not just chasing cost savings anymore—they’re prioritizing resilience and regional security.”

— Ajay Banga, President of the World Bank

5 Sectors That Are Leading the Inshoring Drive

1. Semiconductors

The semiconductor industry has become a focal point of reshoring efforts. With over $100 billion in investments in chip production based in America, Intel and TSMC are building top-notch fabrication plants in Ohio and Arizona. The CHIPS Act is accelerating the process even more by offering incentives and tax credits to reduce dependence on Asia.

2. Automotive Manufacturing

The push for electric vehicle (EV) production has led automakers to localize assembly and battery manufacturing. Hyundai’s $7.6 billion EV plant in Georgia is one example of this shift. Additionally, increased tariffs on foreign-made vehicles are driving investment in domestic assembly plants.

3. Medical Devices

The pandemic highlighted the risks of foreign production dependence for essential healthcare equipment. Firms are responding by reshoring fundamental medical device manufacturing, and the FDA is offering incentives for domestic production to ensure a safe supply chain.

4. Apparel & Garments (Niche/High-End)

Although offshore mass-market fashion is the norm, premium and niche garment manufacturing is reshoring. Ethical manufacture and speed-of-delivery brands are making investments in U.S.-based facilities, particularly in military and high-end lines.

5. Food & Beverage Manufacturing

Due to the easy availability of U.S.-sourced ingredients, food production is one of the most possible industries for reshoring. Federal incentives, logistics advantages, and changing consumer preferences make local manufacture more feasible.

The future of manufacturing isn’t about one country winning over another—it’s about regional ecosystems that offer speed, security, and sustainability.”

— Richard Baldwin, Economist and Author of The Great Convergence

Challenges & Considerations

Despite the push for reshoring, significant challenges remain:

- Higher Labor Costs:

U.S. pay scales are much higher than those in developed manufacturing hubs, so controlling costs is a significant issue. - Shortages of Skilled Workers:

Multiple industries struggle to fill advanced manufacturing jobs with skilled workers. - Capital Investment Necessary:

Constructing or increasing local plants requires considerable capital investment, which can discourage transition timelines. - Hybrid Models in the Making:

A few companies are taking on nearshoring strategies, for example, relocating manufacturing to Mexico or Canada to find cost and proximity balance.

What’s Next for Inshoring?

2025 is likely to become a watershed year for reshoring decisions. The confluence of evolving trade policies, customer needs, and government initiatives will likely keep redefining manufacturing plans. For businesses, awareness of these trends—and strategic adaptation—will be the mantra to stay ahead in an evolving world market.

Whether or not inshoring is a good idea depends on the industry, cost structure, and long-term strategic goal. One thing is certain: the conversation about reshoring is not a trend—this is a revolution transforming the future of manufacturing.

Explore more related content

Strategic Global Sourcing: How Companies Move from Cost Saving to Competitive Advantage

Strategic Global Sourcing: How Companies Move from Cost Saving to Competitive AdvantageSupply chain disruptions now...

Critical Minerals, Critical Thinking: Building Resilient Electronics Supply Chains

Critical Minerals, Critical Thinking: Building Resilient Electronics Supply ChainsThe global economy is expected to...

Cybersecurity for Smart Factories: A 2025 Playbook for OT Resilience

Cybersecurity for Smart Factories: A 2025 Playbook for OT ResilienceWhy "smart" now means "secure" or not at all Smart...